How is borrowing capacity calculated

Borrowing by Entities under Investigation. Usually interest rates for finance costs are not published.

Hard To Borrow Fee Calculation Ally

The standard logistic function is the solution of the simple first-order non-linear ordinary differential equation.

. Spend or handle unforeseen expenses. The NCCD portal provides resources the process model and case studies to assist schools to. Collateral is a personal asset you own such as a.

Specifying name of the officials authorised to execute such guarantees on behalf of the company or in individual capacity should be obtained. Your borrowing power is the amount of money you may be able to borrow from a lender. In artificial neural networks this is known as the softplus function and with scaling is a smooth approximation of the ramp function just as the logistic function with scaling is a smooth approximation of the Heaviside step function.

For example if you pay 1500 a month for your mortgage and another 100 a month. Typically if you dont have a deposit of 20 of the propertys bank. FEE-HELP VET FEE-HELP and VET Students Loans borrowing.

High debt levels constrain in most cases the ability of governments to support the recovery and the capacity of the private sector to invest in the medium term. Preparing it helps financial advisors to assist clients in making effective investment decisions. Confirmation of whether the maximum borrowing amount is affordable based on disposable income calculated from income and outgoings.

The combined HELP loan limit for most students includes all FEE-HELP VET FEE-HELP VET Students Loans and HECS-HELP with a census date from 1. Your tuition fees will be charged to your student debt immediately after the census date. The indexation factor is calculated each year to the end of March and is usually confirmed by May.

The United States Government Debt is estimated to have reached 13720 percent of the countrys Gross Domestic Product in 2021. If interest rates rise or unexpected expenses pop up and youre borrowing at your maximum capacity you may not be able to meet your repayments. Our home loan borrowing capacity calculator asks a few personal and financial questions to calculate an estimate of how much you may be able to borrow with Pepper Money.

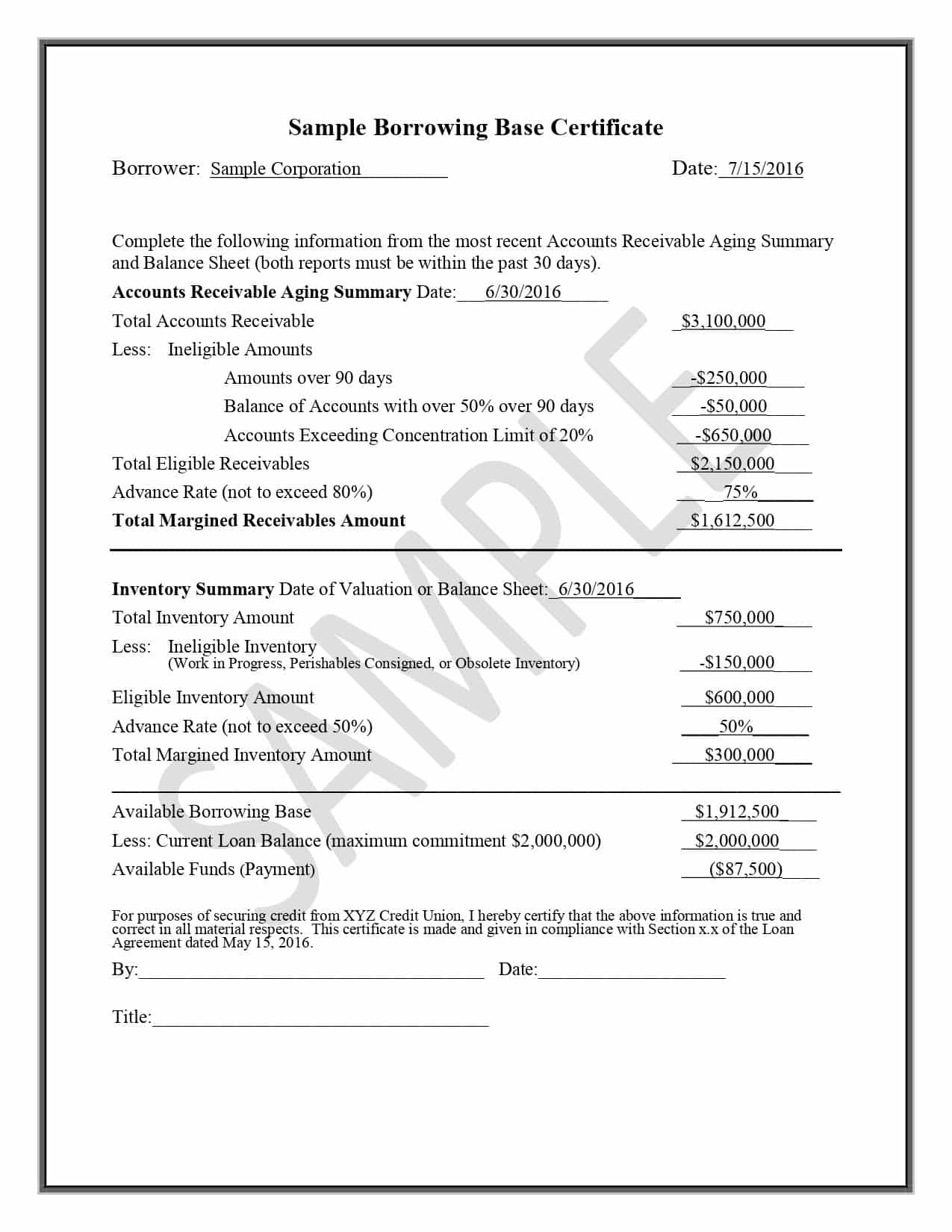

Financial goals and financial capacity. An advance rate is the maximum percentage of the value of a collateral that a lender is willing to extend for a loan. A total debt service ratio TDS is a debt service measure that financial lenders use as a rule of thumb when determining the proportion of gross income that is.

Liabilities are shown on your business balance sheet a financial statement that shows the business situation at the end of an accounting periodThe assets of the business what it owns are shown on the left and the liabilities and owners equity are shown on the right with the liabilities typically appearing above the owners equity because it gets paid back first in the. A point in the study term when enrolments are finalisedFor university courses it. Its calculated daily as a percentage your interest rate of your principal and added to your balance every month.

The advance rate helps a borrower determine what kind of. Government Debt to GDP in the United States averaged 6454 percent of GDP from 1940 until 2021 reaching an all time high of 13720 percent of GDP in 2021 and a record low of 3180 percent of GDP in 1981. Capacity is an indicator of the probability that youll consistently be able to make payments on a new credit account.

A country that is a member of the Financial Action Task. The NCCD is an annual collection of information from all Australian schools on the numbers of students with disability and the adjustments they receive. This comparison rate is true only for the examples given and may.

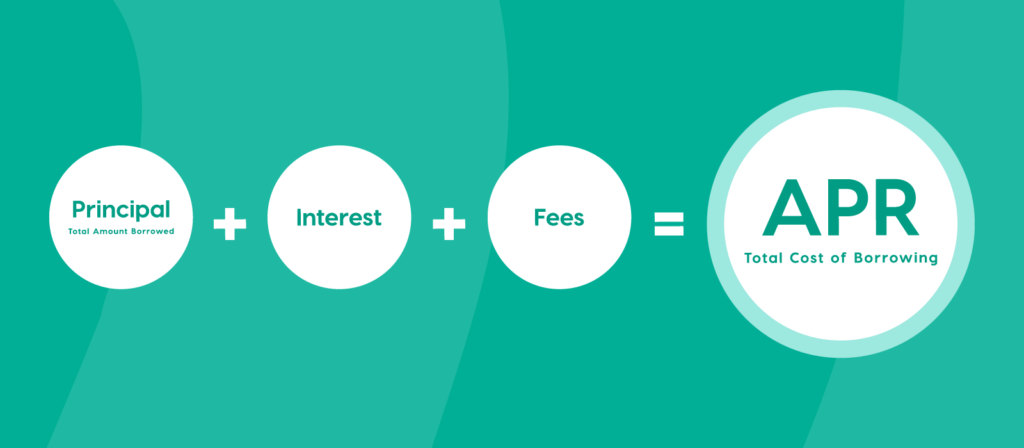

HELP works like this. The ratio will be calculated as per latest audited balance sheet. Usually borrowing costs are calculated using the Annual Percentage rate APR.

Variable rates are calculated monthly not in advance. When you apply for credit lenders evaluate your DTI to help determine the risk associated with you taking. Borrowing by governments accounted for slightly more than half of the increase as the global public debt ratio jumped to a record 99 percent of GDP.

Learn how DTI is calculated see our standards for DTI. This page provides - United States. All Comparison Rates are calculated based on a secured loan of 150000 and a term of 25 years.

In addition to your credit score your debt-to-income DTI ratio is an important part of your overall financial healthCalculating your DTI may help you determine how comfortable you are with your current debt and also decide whether applying for credit is the right choice for you. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. Other factors like your credit score and whether you have a guarantor can also play a role.

It is done by assessing an individuals capacity interest and willingness to take and manage risks. What is my borrowing power. Your debt-to-income ratio is calculated by adding up all of your monthly debt payments and dividing them by your gross monthly income.

The report can be based on any financial circumstance and used to explore how changes in financial circumstances might affect capacity to. The Variable Rates represents a variable rate of interest announced by Interior Savings Credit Union from time to time as the CreditMaster Rate or theWorks mortgage rate. Total Debt Service Ratio - TDS.

With this DTI ratio lenders may limit your borrowing options. It is based on your financial situation including how much you earn your expenses your existing debts and the size of your deposit. We would like to show you a description here but the site wont allow us.

Borrowing Base What It Is How To Calculate It

Customer Management Crm And Suppliers Proper Management Of Customers And Suppliers Increases The Organizational Efficiency And Investing Crm Organizational

Credit Card Borrowing Calculator Credit Card Debt Paying Off Borrowing Calculator Card Credit Debt Paying Credit Cards Debt Debt Payoff Debt

Borrowing Base What It Is How To Calculate It

Making An Offer On A House Below Asking Price In 2022 In 2022 First Home Buyer Home Loans Things To Sell

Pin By Catie Mepham On Home Home House The Borrowers

12 Month Introductory Rate Special P N Bank The Borrowers Home Loans Personal Loans

Hard To Borrow Fee Calculation Ally

Cairns Houses For Sale How Hecs Can Affect Your Mortgage Borrowing Power Real Estate Photography Selling Real Estate Real Estate

Where Art Thou Plot Of Dirt Residential Land Commune The Borrowers

Buying A House Here Is The Home Loan Application Process If You Need Help Please Call Mortgage Choice Jody Shadg Loan Application Mortgage Mortgage Lenders

Learn The True Cost Of Borrowing Birchwood Credit

What Can Affect Your Borrowing Power

Lvr Borrowing Capacity Calculator Interest Co Nz

What Is An Open House By Appointment Only In Nyc Hauseit

How Do Car Loans Affect Your Financial Position The Broke Generation Car Loans Financial Position Budgeting Tips

How Much Can I Borrow Home Loan Calculator